Southwest Airlines has announced a new interline partnership with Condor, marking one of the carrier’s most notable international connectivity moves in years. Beginning January 19, 2026, travelers will be able to book single-itinerary travel that combines Southwest domestic flights with long-haul Condor service to Frankfurt.

While this is not a codeshare or a loyalty integration, it represents an important shift for Southwest — and potentially the first step toward broader global connectivity.

Overview of the Partnership

The agreement allows passengers to book a single ticket that includes Southwest’s U.S. segments and Condor’s transatlantic flights. Checked bags will be transferred, itineraries will be protected, and travelers will not need to manage separate reservations.

This is Southwest’s most significant international partnership in years, and it effectively plugs the airline into Europe via Condor’s Frankfurt hub.

Key Details

Start Date

Travel under this partnership is scheduled to begin on January 19, 2026.

Gateway Cities

Southwest will connect passengers into several U.S. airports served by Condor, including:

- Las Vegas (LAS)

- Los Angeles (LAX)

- Seattle (SEA)

- San Francisco (SFO)

- Boston (BOS)

- Portland (PDX)

These cities will act as transfer points for onward travel to Frankfurt and beyond.

Booking Structure

At launch, itineraries combining Southwest and Condor will be sold as single tickets, with both carriers’ flights appearing on the same reservation. Distribution may expand over time, but for now this is a straightforward interline arrangement rather than a deep commercial joint venture.

Baggage Transfers & Protections

Checked bags will be tagged through to the final destination, and passengers will have standard protection in the event of misconnects or irregular operations. That’s a meaningful improvement over booking separate tickets on two unrelated carriers.

Why This Partnership Matters

While this is a relatively simple interline agreement on paper, it introduces several important benefits for U.S. travelers.

1. Easier Access to Europe

For Southwest-heavy markets — especially in the western United States — this partnership adds a new pathway to Europe without requiring travelers to switch to a legacy hub carrier or book separate tickets. Passengers can remain on a familiar domestic airline while gaining access to long-haul service across the Atlantic.

2. Connectivity to Condor’s Long-Haul Network

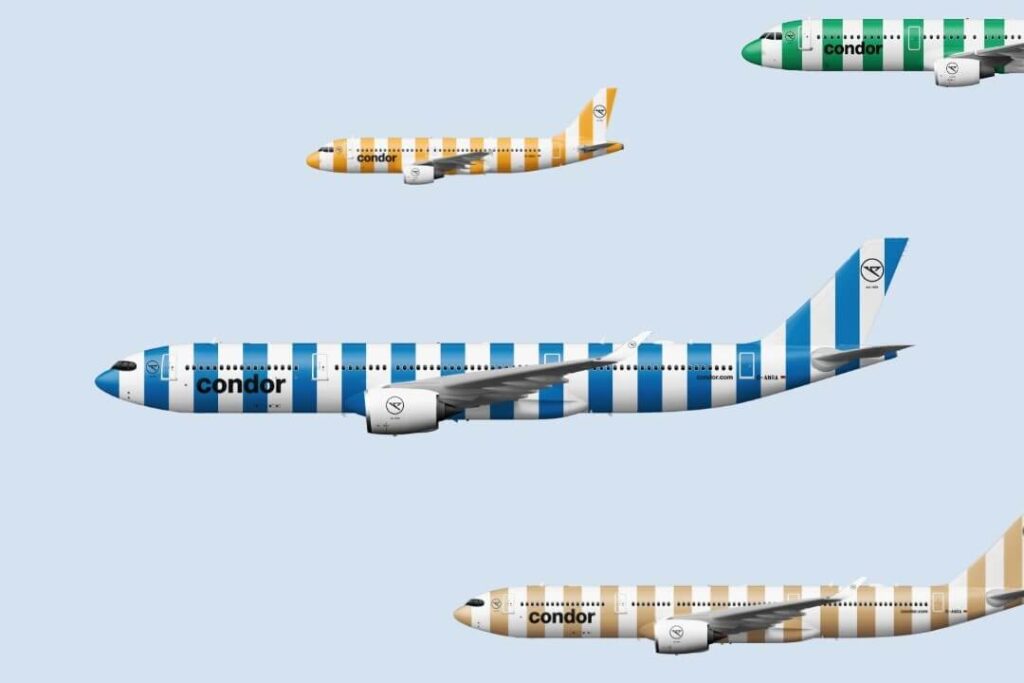

Condor operates a growing long-haul network centered on Frankfurt, serving a mix of major European cities and leisure-focused destinations. With a modern long-haul fleet and refreshed cabins, the airline offers another option for travelers looking beyond the traditional transatlantic players.

3. Increased Competition

Additional connectivity between U.S. secondary markets and Europe tends to put pressure on fares, particularly during peak travel periods. This partnership has the potential to introduce more one-stop options and, over time, more competitive pricing between the U.S. and Europe.

4. A Potential Foundation for Future Expansion

Southwest has historically avoided alliances and deep long-haul partnerships. By stepping into an interline deal with a European carrier, the airline is showing a new willingness to explore international connectivity. Many partnerships begin at the interline stage and may later evolve into more robust cooperation, though nothing further is guaranteed here.

What the Partnership Does Not Include

To set realistic expectations, it is important to understand what this agreement does not provide at this time.

No Loyalty Integration

There is no mileage earning, redemption, or elite-status recognition between Southwest’s loyalty program and Condor’s. Travelers should not expect to earn Southwest points on Condor segments, nor redeem points for Condor-operated flights under this arrangement.

No Codesharing

Flights will not carry each other’s flight numbers. This is a standard interline agreement rather than a codeshare. From the customer’s perspective, that means functional connectivity but no shared-brand experience.

No Coordinated Network Strategy

The partnership does not imply joint network planning or highly coordinated schedules. It is primarily focused on enabling through-ticketing and baggage transfer rather than reshaping either carrier’s route map.

Practical Implications for Travelers

For many travelers, the most tangible benefit will be the ability to book a single, protected itinerary from a Southwest-served city to a destination in Europe via Frankfurt. Instead of piecing together separate tickets and hoping connections work out, passengers can rely on through-ticketing and baggage handling.

This is especially useful for travelers in cities like Las Vegas, Seattle, or Portland, where nonstop transatlantic options are limited and connecting itineraries can be cumbersome.

For points and miles enthusiasts, the value is more nuanced. Without loyalty integration, this partnership does not open obvious new avenues for high-value award redemptions or elite-qualifying mileage runs. However, it does expand the number of routings to consider when looking for competitive cash fares or convenient one-stop options to Europe.

Analyst Perspective

Southwest has long built its brand around simplicity: point-to-point flying, a strong domestic focus, and minimal involvement in traditional global alliance structures. This interline agreement does not change that core identity, but it does suggest a more flexible approach to international connectivity than the airline has historically embraced.

For Condor, the benefits are straightforward. The carrier gains additional feed from Southwest’s domestic network into its Frankfurt hub, tapping into customer bases in secondary and leisure-focused U.S. markets that previously required more complex itineraries.

For travelers, the result is a new transatlantic option that did not exist before — particularly appealing to those who already fly Southwest regularly and would prefer to maintain that relationship while venturing farther afield.

Looking ahead, the key question is whether this partnership remains a simple interline agreement or evolves into something more substantial. Deeper cooperation could eventually include expanded distribution, codesharing, or even limited loyalty recognition. At this stage, however, that remains speculative.

Bottom Line

Southwest’s new interline partnership with Condor introduces a fresh way for U.S. travelers to reach Europe, particularly from Southwest-dominated cities in the western United States. It simplifies booking, improves protection during irregular operations, and offers an additional alternative to legacy transatlantic carriers.

It does not revolutionize the loyalty landscape, and it does not create new opportunities to earn or redeem points across the two airlines. Still, as a convenience upgrade and a strategic signal from Southwest, it is a development worth watching.

For now, travelers should view this as a practical new option for reaching Europe more easily — and a sign that Southwest is cautiously opening the door to a more connected global future.

Leave a comment